tax loss harvesting wash sale

A wash sale is a sale of a security at a loss and repurchase of the same or substantially identical security shortly before or after. When you use tax-loss harvesting you can use realized.

Wealthfront Tax Loss Harvesting Wealthfront Whitepapers

Losses from such sales are not deductible in most cases under.

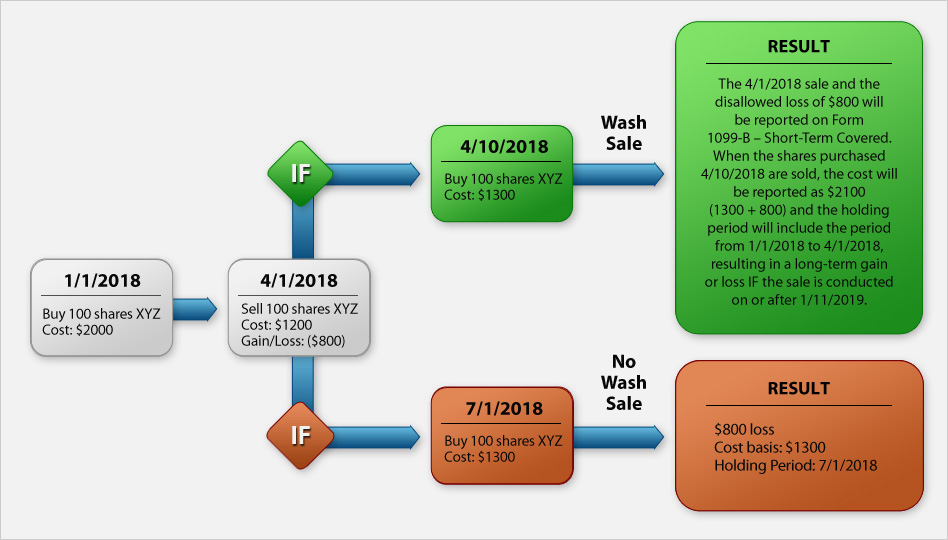

. Therefore the tax basis of the Beta shares you acquire on December 19 2021 increases to 20200 12200 cost plus 8000 disallowed wash sale loss. If you think about this rule it makes sense. Because gains in retirement accounts are tax-deferred there is no tax impact until you.

The wash sale rule adds greater complexity to tax-loss harvesting. Higher income earners can currently pay up to a 238 tax rate on realized long-term capital gains. Tax-loss harvesting may now be more attractive with the SP 500 Index down by.

I think I did this right but Im not sure. Federal government allows investors to. Watch out for the wash sale rule The IRS wont allow you to sell an investment at a loss and then immediately repurchase it known as a wash sale and still claim the loss.

Yeah yeah I know that I should know exactly what Im doing first. I think I do but figured that this answer could. Harvesting a loss too early could mean passing up a bigger temporary lossmade unavailable due to wash sale constraints stemming from the first harvest.

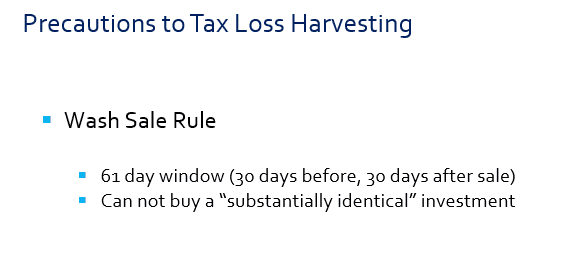

Wash Sale Rule. Heres how investors can avoid violating wash sale rules when realizing tax losses In a down market you may consider tax-loss harvesting which can turn portfolio losses into tax. Offset realized capital gains.

If you buy the same. Tax loss harvesting and wash sale rules. It prohibits an investor from claiming a loss if he or she sells a security and buys a substantially identical.

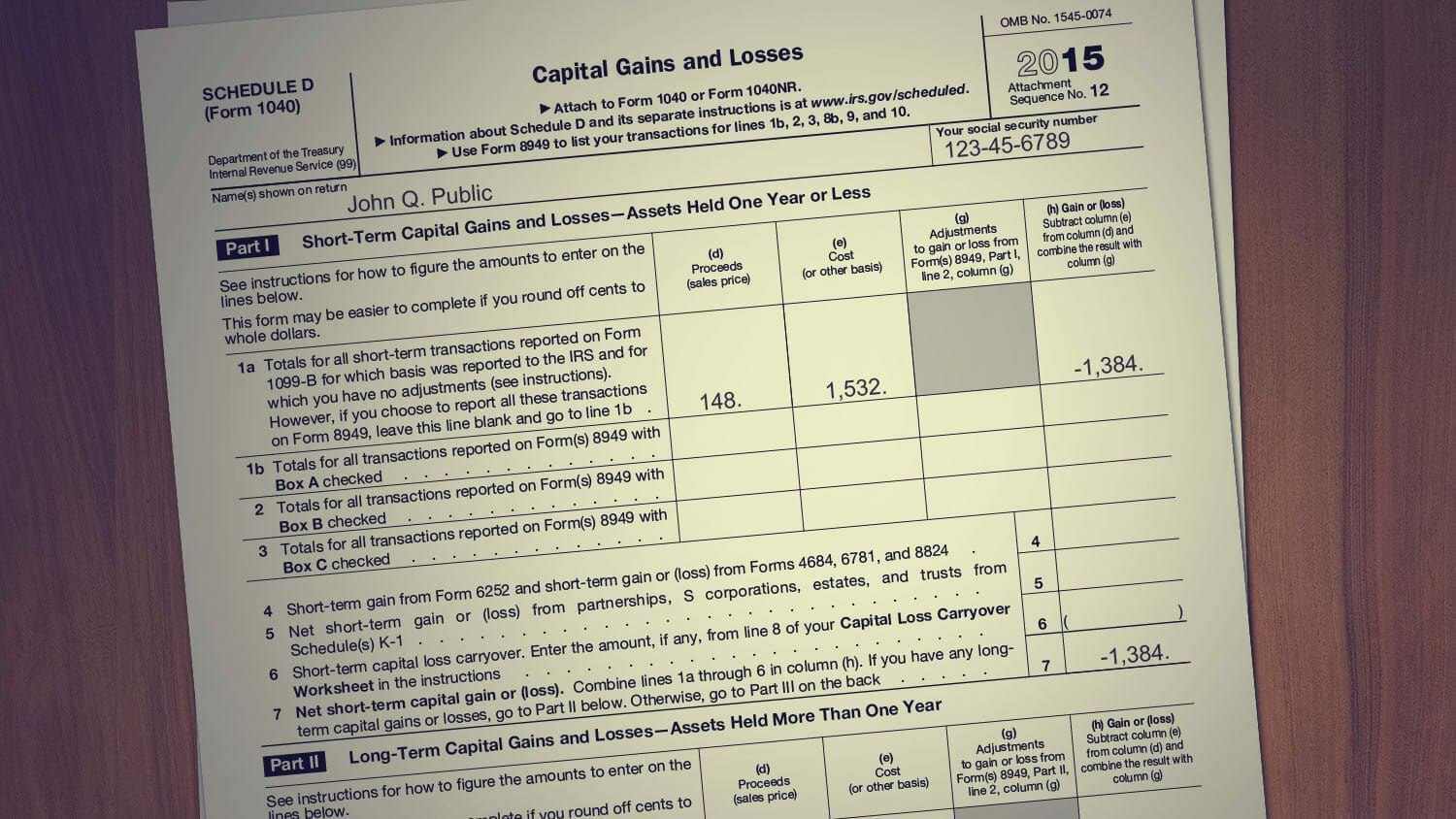

The wash-sale rule is a regulation that prohibits a taxpayer from claiming a loss on the sale of stock while essentially maintaining a position in it. Once losses exceed gains you can subtract up to 3000 per year from regular income. Federal government allows investors to.

Two Ways to Beat. If you do have a wash sale. One thing to note is that tax loss harvesting and wash sales apply only in taxable accounts.

The wash-sale rule prohibits selling an investment for a loss and replacing it with the same or a substantially identical investment 30 days before or after the sale. If you sell a fund for a loss to tax-loss harvest it you may not re-buy a substantially identical fund for 30 days. Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US.

Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US.

What Is Tax Loss Harvesting Ticker Tape

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Wealthfront Tax Loss Harvesting Wealthfront Whitepapers

What Is Tax Loss Harvesting Smarter Investing

Wash Sale Problems When Tax Loss Harvesting Mutual Funds Etfs

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Crypto And Tax Loss Harvesting Wash Sale Rules And The Benefits Downsides R Cryptocurrency

A Loss Harvesting Caveat Level 5 Financial Colorado Springs Colorado

Crypto Tax Loss Harvesting Investor S Guide Koinly

![]()

Ato Warns Crypto Users To Avoid Wash Sales Cointracker

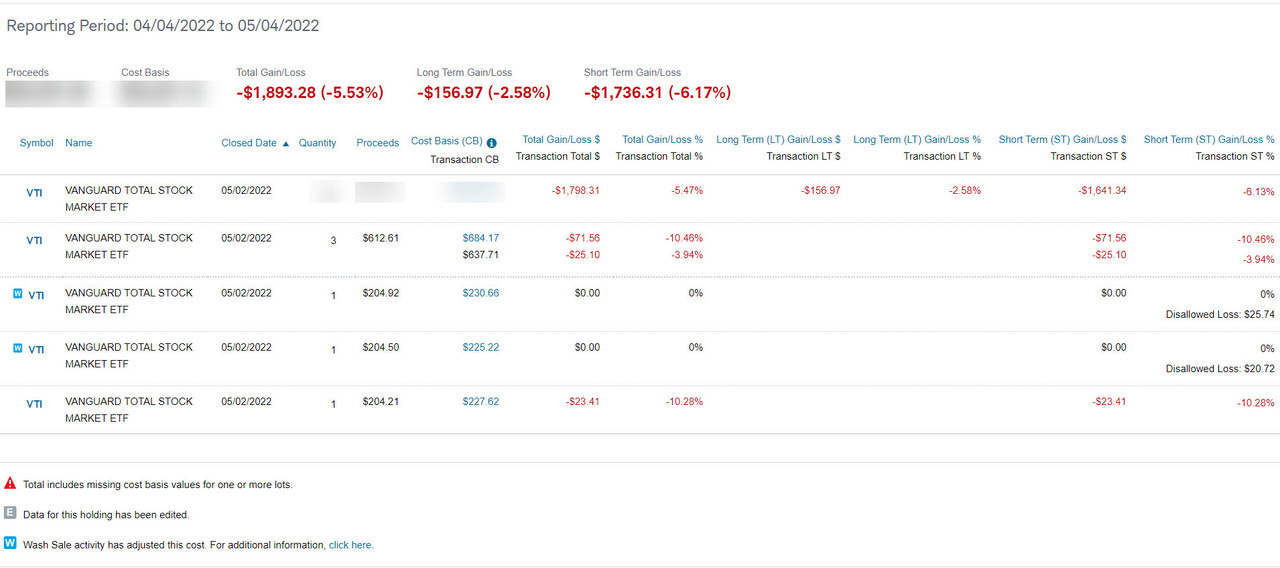

Tax Loss Harvesting Real Example Of A Wash Sale And Irrelevant Wash Sale Bogleheads Org

Crypto Taxes Usa 2022 Update What You Should Know

09 Rules Of Tax Loss Harvesting Wash Sales 1 Arnold Mote Wealth Management

Tax Loss Harvesting Real Example Of A Wash Sale And Irrelevant Wash Sale Bogleheads Org

The Irs Untold Secret Tax Loss Harvesting Seeking Alpha

Wash Sale Rule How To Keep Your Tax Loss Claims Clean Forbes Advisor

.png)